We are living in the era of digitization, where all payments – online shopping, taxi booking, money transfer, etc. – are done online. Cash and card payments are losing prevalence as one-tap payments are coming to the mainstream. Mobile wallets like PayPal and Stripe have been out for a while now. But advancements like digital authentication and ‘buy now, pay later’ are constantly revolutionizing the mobile payments market. In this article, we’ll talk about Klara, a Sweden-based mobile payments app that has introduced a new era of online shopping. Lastly, we’ll discuss the typical features and benefits of Klarna-like mobile payments apps and how you can get one for your business. Excited? Let’s jump in. Table Of Contents

- What is Klarna?

- How has the Klarna app grown over the years?

- The mobile payment apps market

- Klarna business model

- Klarna Revenue Model

- Other popular mobile payment apps in Sweden

- Why should you develop a Klarna-like app?

- Benefits of having a Klarna-like mobile app for your business

- Typical features of a Klarna-like app

- Future trends in mobile payment technology

- How to develop a Klarna-like mobile payment app for your business?

- Required technologies

- The cost of development of a Klarna-like app

- Why choose Esferasoft for mobile app development?

- Conclusion

What is Klarna?

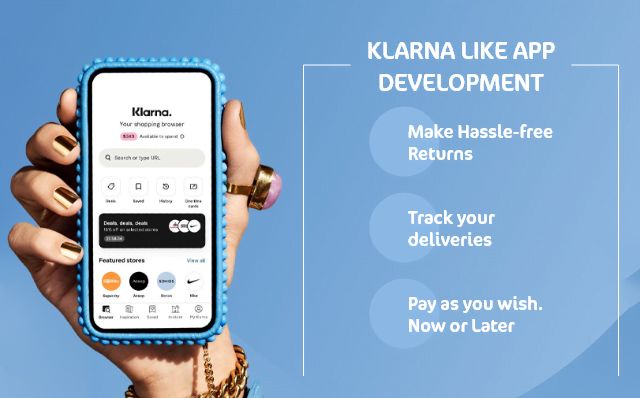

Klarna is a mobile payments app owned by Klarna Bank AB. It is a one-stop shopping app that allows you to take control of your personal finances. One of the most striking features of the Klarna app is that it enables you to buy first and pay later. Let’s take a quick look at the main features of the Klarna app.

- Pay as you wish: Shop as you want, pay now, later, or split it.

- Snooze your payment: If you need more time to make the payment, you can snooze it in your app and pay later.

- Handle your payments: You can manage all your payments and finances in one app.

- Push notifications: Never miss a payment again with Klarna’s in-app push notifications.

- Try before you buy: Purchase the items, try them, and return them if you’re not satisfied. You don’t have to pay for the items in the meantime.

- Track your deliveries: Get real-time information about your orders.

Let’s also take a look at the payment options that Klarna offers. Installments: Customers can split their purchase into four equal payments, without paying any interest or extra fee. Financing: For larger purchases, Klarna offers flexible financing options ranging from 3-36 month plans. Pay in 30 days: You give your customers a chance to try the product before paying for it. As a merchant, you get the payment upfront, leaving all the risk to Klarna. How has the Klarna app grown over the years? If you don’t already know, Snoop Dogg is one of the investors of Klarna. As discussed, Klarna works on the ‘Buy Now Pay Later’ model, an online shopping trend that is gaining considerable popularity. The online shopping market is on the rise, and there are no signs of slowing down. This has also led to increased competition, which has encouraged retailers to become more creative around online payments. Klarna is one of the first companies to enter the ‘buy now, pay later’ segment, and soon became the largest private fintech company in Europe. It was valued at $5.5 billion, and it also raised more than $460 million in funding in the year 2019. Klarna launched its shopping app in the US in 2018 and went viral instantly. To date, the Klara app has more than 8- million happy shoppers from around the world, and the number is growing. The mobile payment apps market It’s essential to talk about the rise of the mobile payments market over the past years. The mobile app payment market was valued at $601 billion in 2016 and is anticipated to reach $4,576 billion by 2023, at a whopping CAGR of 33.8%. This growth rate is one of the highest among all the growing industries in the world right now. Mobile payment apps offer a hassle-free purchase of goods and services from your mobile phone. This increased convenience has raised the popularity of mobile payment apps, and by 2023, there will be more than 1.3 billion mobile payment transaction users worldwide. Big players like Apple, Samsung, and Google are also working on new strategies to expand their share in the mobile payment market. The effect of COVID-19 pandemic Mobile payments were already on the rise, but the COVID-19 pandemic has resulted in a paradigm shift in how people are making transactions. Mobile payments have now overtaken card transactions. And this trend is quite justified. People are taking all possible measures to avoid human contact. Mobile payment apps allow contactless transactions, which provide a safety advantage amid the COVID-19 pandemic. Klarna business model Before getting into how Klarna earns revenue, it’s critical to understand its users, and how it creates value for them. Klarna’s users are divided into two groups: eCommerce merchants and end-customers. The merchants use Klara to enhance their online payment options and attract customers looking for seamless payment options. End-customers, which make up for 75% of the app users, use Klarna to find amazing deals, discounts, and flexible payment options. Value for merchants Here’s how Klarna creates value for eCommerce merchants.

- Provides a payment service that is effortless to set up on mobile apps and websites

- Reduces the risk of fraud

- Increases conversions

- Speeds up and simplifies payment cycle

- Offers financing for no extra cost or risk to merchants

Value for consumers Here’s how Klarna creates value for its end-consumers.

- Simplifies and speeds up the payment process

- Allows payment after delivery

- Provides instant access to credit cards

- Allows consumers to manage their payments

Klarna Revenue Model

Now, let’s discuss how Klarna makes money. Klarna’s revenue model relies on charging fees from eCommerce merchants and customers who pay late. In short, Klarna makes money by acting as a payment processor between the merchants and consumers. Fees for eCommerce merchants Klarna charges a setup fee, monthly fee, and a small percentage of transactions from the merchants. The setup cost for merchants is $600. Then, the merchants need to pay $90 per month and 1.5-3% for each transaction. The fee is comparable to other mobile payment providers, like PayPal and Stripe (2.9%+$0.30 per transaction). However, Klarna has a high monthly fee of $90, compared to $30 for PayPal. Stripe doesn’t charge any monthly fee. Fees for customers Klarna doesn’t charge any fee from its consumers if they use the “Pay After Delivery” option and repay their debt in 14 days of the purchase. After 14 days, $10 is charged per missed deadline for a maximum of three deadlines. If the users still don’t pay their debt, further action is taken. Klarna charges an interest rate of 18.9% APR on “Buy Now, Pay Later purchases if the balance in the account is not cleared by the end of the billing month. For end-consumers, Klara’s revenue model works more or less the same as a credit card provider. Other popular mobile payment apps in Sweden Sweden is on its way to entirely digitize payments happening across the country. Apart from Klarna, there are various popular mobile payment solutions in the country. Let’s take a look at some of them. Swish Launched in 2012, Swish is one of the oldest and most popular mobile payment systems in Sweden. The app had more than 6.5 million users in 2018. The user needs to install the app and register using their phone number. The phone number should be connected to their bank account, which makes money transfer possible in real-time. PayPal PayPal is an online commerce platform that allows individuals and companies to accept and make payments without disclosing sensitive payment information. Backed by bank-level technology, PayPal ensures secure transactions between two parties using all types of credit and debit cards that PayPal supports. MyWallet MyWallet is another popularly used mobile payments app in Sweden. It is a digital wallet application that supports all Apple Wallet-based digital cards. The app supports real-time updates for several pass types, including Store Card, Coupon, Event Ticket, Boarding Pass, Generic, etc. Why should you develop a Klarna-like app? This comes without saying that mobile payment apps are taking the world by storm. The use of cash has almost diminished, and card payments are also witnessing a significant decline. In such a revolutionizing market, launching a Klarna-like app would be an excellent decision for your business. Let’s discuss some benefits of having a Klarna-like app for your business. Benefits of having a Klarna-like mobile app for your business If you’re an eCommerce merchant or retailer, having a mobile payment app can go a long way in boosting your visibility, customer engagement, and profits. Let’s take a look at some benefits of offering mobile payments to your customers. Incentive programs One of the most significant benefits of using a mobile payment option is the ability to offer loyalty and incentive programs to your customers. When customers get a reward for making a purchase with you, they are more likely to return. A mobile payments app allows you to offer such a rewarding experience for your customers. Offer credit card payments Previously, small retailers like grocery sellers or food trucks were not able to accept credit card payments. Thus, they were forced to be a cash-only business, which decreased their sales. A mobile payments app allows you to accept credit card payments, which immediately increases your customer base and revenue. Track customer inventory and trends Data is the fuel for businesses in 2020 and beyond. Many small businesses struggled to collect customer information, which made it difficult for them to know what their customers are exactly looking for. A Klarna-like payments app allows you to track the inventory and behavior of your customers. You can follow your customers’ browsing and shopping behaviors to figure out what they’re looking for. You can then use this information to send targeted advertisements to your customers, and also improve your customer service. Increased checkout People can’t wait, especially when making a payment, which is probably the least favorite part of the shopping experience. Most consumers find mobile payments a quick and convenient way to pay compared to cash or credit cards. Besides, customers are more likely to return to you if they don’t have to wait a long time. These time savings can also translate into increased profits as you can accommodate more customers in less time. Save money or credit card fees

Most mobile payment companies charge less per transaction than credit card companies. This can equate to direct savings for your company.

Typical features of a Klarna-like app

You don’t necessarily need to offer “buy now, pay later” functionality like Klarna, but there are a few features every mobile payments app should have. These include:

Top-notch security

The world is getting digital, and users are saving all their personal information in apps. This gives a lucrative opportunity to cyber attackers. The loss of business or customer data can not only cost your business in terms of money, but trust and customer loyalty as well. So, most payments apps have a strong and effective security system in place.

App performance

Consumers want to make payments quickly. They’re always looking for solutions that are fast, easy-to-use, and high-performance. Most apps are lightweight and quick to load to ensure your customers don’t get turned off by the awful experience.

Portable

Most mobile payment apps allow users to add money and make transactions via multiple channels. Most people use e-wallet apps because of this functionality.

Rewarding system

In a cutthroat market, rewards are an excellent way to attract and engage customers easily and effectively. Mobile payment apps have in-built loyalty program features, so you can easily attract both existing and new customers.

Categorization

Providing this feature can go a long way in enhancing the experience of your app users. The categorization function makes sure all credit cards, debit cards, online banking, and other payment options are organized in different categories. This makes it easy for customers to select their favorite payment option.

Budgeting

Providing budgeting capabilities in your mobile payment apps is optional. This feature allows users to track their spendings and manage their finances better.

In-app capabilities

Modern-day mobile payment apps are more than just transaction terminals. They allow in-app features like shopping, booking hotels and flight tickets, and paying bills.

Future trends in mobile payment technology

The current mobile payment ecosystem has already disrupted the way we collect and pay money. But with the rise of digitization and the adverse effects of COVID-19, the mobile payment industry is set to evolve. Here are a few mobile payment technology trends to follow.

Mobile payments

Mobile payments are the trend of the century. However, mobile wallets only accounted for $75 billion in transactions in 2016. This number is expected to reach $500 billion by 2020, at an unreal CAGR of 80%. Thus, mobile payment companies will dominate the upcoming decade.

Increased focus on speed and user experience

One of the main reasons why people use mobile wallets is because they provide a quick and easy way of making payments. In the upcoming years, mobile payment companies will focus on further simplifying and speeding up the transaction procedure for users.

Digital authentication

The rise in mobile wallets has also resulted in an increase in security concerns. Mobile wallet providers are focusing on dual authentication for use to ensure no unauthorized person can get access to the wallet of a user. In the future, we might also see a digital procedure for ID verification as well.

The disappearance of physical payment cards

As discussed, the use of physical credit and debit cards is already on the decline. And the growth of mobile wallets means there’ll be a further plunge in the use of physical payment cards.

That doesn’t mean the use of physical cards will go away. More than 70% of Americans use at least one credit card, and more than 15% of them have more than five cards. So, cards are here to stay, but their use to make payments will reduce.

Mobile PoS

Mobile Point of Sale (mPOS) is another trend that’s reshaping the retail industry. mPOS units are wireless devices that work similarly to sale terminals and cash registers. But they are wireless, space-saving, and portable. Apple is one of the brands to truly implement mPOS systems. In Apple stores, you don’t need to take your items to the cashier. Instead, you can check out with any employee.

The use of mPOS devices is on the rise. In 2014, there were 3.2 million mPOS devices, and this number is expected to increase to 27.7 million by 2021.

Social shopping

Social media is gaining reputation is a lucrative sales channel. Mobile users spend most of their time on social media, and if they want to purchase a product, they no longer need to leave the app. They can simply click the “Buy Now” button and purchase their favorite products. The rise of mobile wallets like Klarna has given a massive lift to social shopping, and this trend is expected to continue in the future.

How to develop a Klarna-like mobile payment app for your business?

Developing a mobile payment app like PayPal and Klarna can be challenging and time-consuming. But you can cut down your time and load if you follow the right approach. Here’s a step by step process to creating a mobile payment app.

Project scoping

In this stage, you determine the platform for which you’re building your app: Android, iOS, Web. In this stage, you also identify the features you want in your app, such as ID verification, push notification, and core online payment features.

Select the SDLC model

Once you have the features and platforms on paper, launch a Minimum Viable Product (MVP). Get real-time market feedback and enhance the app.

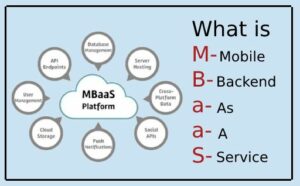

Formulate a development approach

You can use Platform as a Service (PaaS) and Mobile Backend as a Service (MBaaS) to develop mobile web and mobile apps. Implement the desired features using Software Development Kits (SDKs) and Application Programming Interfaces (APIs).

Build a team

Once you’ve created an actionable blueprint for your project, build a team with developers, designers, testers, and a project manager (PM).

Subscribe with a cloud provider

Unlike large enterprises, startups don’t have enough funds to invest in building an IT infrastructure. Therefore, cloud-based solutions like AWS Elastic Beanstalk and AWS Amplify could be great picks.

Get an online payment solution

Use API/SDK solution to implement core online payment functionality features.

Procure an ID verification system

Your online payment app will need an ID verification solution to comply with government regulations. ID.me is one of the best ID verification solutions for the financial services industry.

Develop your app

Now that you’ve sorted all platforms and requirements start developing your app.

Test and deploy

Run rigorous testing before launching your Klarna-like mobile payments app.

That was long, wasn’t it? If you don’t have the right team and resources in place, developing a mobile payments app can seem impossible. Esferasoft can help. Stay tuned to know what Esferasoft can bring to the table.

Required technologies

Here’s a list of the common technologies used in developing a Klarna-like mobile payment app.

Nexmo: For SMS, Voice, and Phone verification Database: MongoDB, MySQL, PostgreSQL, Cassandra

Payment: PayPal, Braintree, E-banking, E-wallets, PayUMoney

Front End: Angular, JQuery, CSS, HTML5, Bootstrap, Javascript

Push Notifications: Push.io, Twilio, Amazon SNS, AdPushup, Map, Urban Airship

Data management: Datastax

Emails: Mandrill

Cloud: Azure, AWS, Google Cloud, Salesforce

Real-time Analytics: Big Data, Cisco, Hadoop, Spark, IBM, Flink

Zbar: For QR code scanning

The cost of development of a Klarna-like app

Now that you know the technologies and processes involved, let’s talk about the costs.

In a nutshell, there’s no specific price for mobile payment app development. It depends on a variety of factors, such as technology, features, functionality, development rate, and more.

If you’re a startup developing a simple app with basic functionality, you can get an MVP for $20,000, or even less.

On the other hand, a full-fledged app with robust functionality might cost $50,000 or even more. These solutions are ideal for large enterprises and investors who are planning to compete in a vying market.

The location also plays a critical role in the overall cost of app development. Developers in India and Indonesia are seven to ten times less expensive than developers in North America and Europe.

So, a mobile payment app that costs $50,000 in the US might cost $5,000-10,000 in South Asia.

Why choose Esferasoft for mobile app development?

Esferasoft is India’s leading digital solutions provider with years of experience and expertise in developing mobile payment solutions. We deploy end-to-end intelligent mobile payment processing technology for reliable payment transfers and secure data collection for all types of business models.

Here’s an overview of the mobile payment services we offer:

- Custom mobile payment systems

- Mobile wallet development

- Mobile payment processing solutions

- Payments integration with mobile apps

- Mobile POS systems

- Mobile payments security

Esferasoft is focused on offering high-quality solutions at affordable prices. Whether you’re a startup looking for a regular payments app, or an enterprise willing to compete with mobile wallet giants across the globe, Esferasoft can help.

Conclusion

With the internet and mobile being the drivers of the 21st century, mobile applications have completely changed the way we manage our finances and make payments. From online shopping to bill payments to checking account balance, mobile payment applications provide it all in one consolidated location.

And as we move down the line, the demand for mobile payment solutions will rise. Thus, developing Klarna-like mobile wallet apps could be an excellent idea for startups and enterprises. If you’re looking for a reliable and cost-effective mobile app development company, get in touch with Esferasoft for a free consultation.